Resources, Education, and Opportunities for Legal Professionals

Attorney Access is a dedicated digital hub designed specifically for legal professionals in the elder care planning space. As part of our ongoing commitment to support and uplift elder care planning professionals, Attorney Access delivers a comprehensive experience with tools to facilitate Medicaid planning, expert-led resources for marketing and practice building, boundless educational resources, CLE courses and seminars, documents to use in client conversations, and so much more.

Attorney Access Basic

An essentials-only approach to maintaining your practice

- Planning Figures & Resources

- KrauseCAST Webinar Series

- Educational Video Library

- Attorney Message Board

- Downloadable Client Resources

- Saved Content Library

- Annual Krause Report

- Insightful White Papers

Attorney Access Premium

An enhanced experience for access to additional tools and opportunities

- All Basic Features, Plus:

- Free Live and On-Demand CLE

- Annuity and Medicaid Planning Calculators

- Expanded State Medicaid Information

- Marketing and Practice Building Tools

- Searchable Case Law Library

STAY UP-TO-DATE WITH OUR ANNUAL

CONTINUING LEGAL EDUCATION

Continuing Legal Education (CLE) is an essential part of being an attorney, especially in a field like Medicaid planning that comes with continuous changes. Stay in the know about the CLE opportunities we offer throughout the year, including live and on-demand offerings, such as:.

- A self-guided, 6-chapter Master Medicaid Planning course

- Live and on-demand CLE from leaders in the elder law space

- An ever-growing library of state-specific Medicaid planning courses

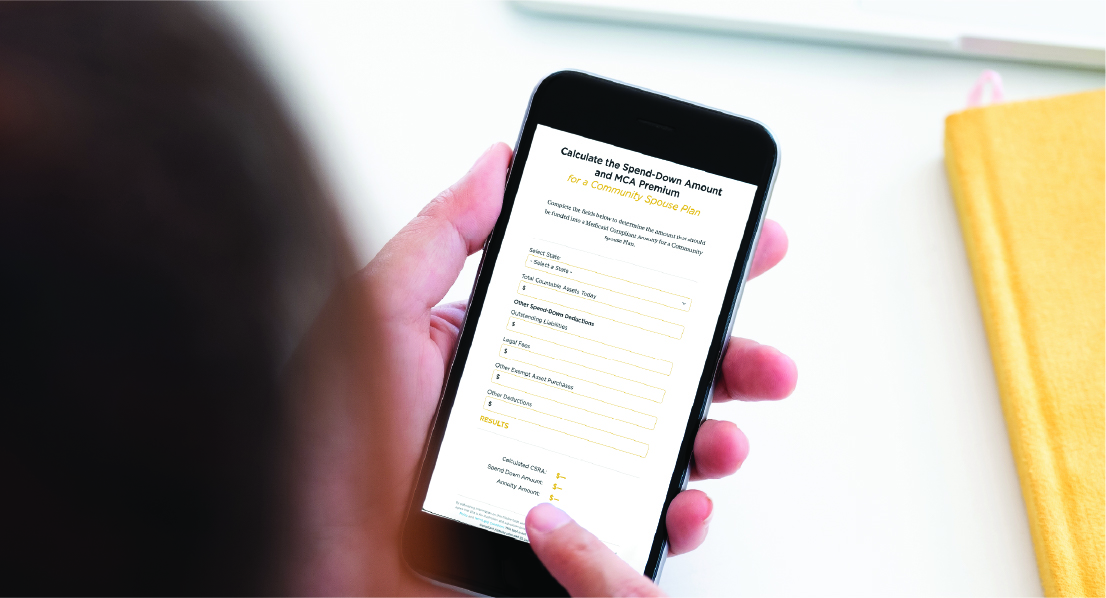

GAIN ACCESS TO OUR INNOVATIVE

MEDICAID PLANNING CALCULATORS

With our easy-to-use Medicaid planning calculators, you can effortlessly determine important figures for your client's case. We offer full annuity plan calculators for both Community Spouse plans and Gift/MCA plans, plus these additional Medicaid planning calculators:

- Community Spouse Resource Allowance (CSRA)

- Monthly Maintenance Needs Allowance (MMNA)

- Penalty Period

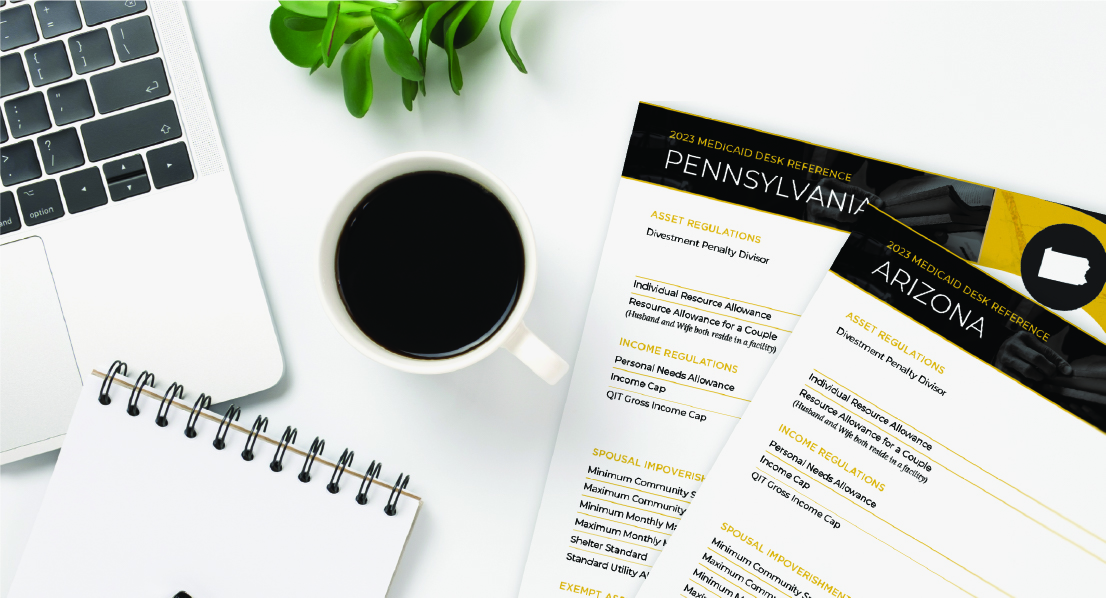

EXPERIENCE THE PERKS OF OUR

INTERACTIVE STATE FIGURES

Attorney Access is your go-to resource for the state-specific figures, rules, and statistics for those in the Medicaid planning space. Premium members can unlock more comprehensive state resources than we've ever offered before, including Medicaid Planning figures and asset treatment rules.

- Access to enhanced state resources for up to three states

- Downloadable desk references for easy printing

- Links to Medicaid manuals and relevant case law

STRENGTHEN YOUR PRACTICE WITH

DETAILED EDUCATION & TRAINING OFFERINGS

Packed with education and training in a variety of formats, your Attorney Access membership allows you to focus on the topics that mean the most to your practice. You'll level up your knowledge with detailed guides, interactive research tools, and engaging videos that cover both broad and hyper-focused topics designed to meet you at your experience level.

- Interactive case law library with case summaries

- Expert-led marketing and practice development tools for attorneys

- Detailed white papers, case studies, videos, and client resources

- Forum for discussing issues, asking questions, and networking